Embracing the Profitability Paradox

The profitability paradox states that revenue margins erode as costs to the company mount. And post-pandemic, the protracted profitability issues have been only multiplying. A Sloan Review analysis of 100 public retail companies’ financial performance reports that EBITA declined 300 points from 2012 to 2019 which was supposed to be a phase of recovery after the Great Recession until the pandemic hit. Since then, again, there have been significant plunges in margins.

Shifting sands

Apart from business as usual, other forces in the market continue to shift.

- Changing consumer behaviour: Today’s consumer has a lot of choices in terms of brands, retail channels, prices, curating their product preferences and their combinations, and social sharing. That makes them enormously powerful. With social media, the tables turn again. From business-to-consumer relations, it is now consumer-to-business in a user-focused economy.

- New competition: New competitors in the furniture retail space have different operating models and cost bases. Many either operate only online, with dark storage facilities, or with a small number of stores that help save on the cost of the property, human resources, logistics, and so on.

- Rising costs: For traditional furniture retailers, sales, general, and administrative expenses need to manage besides the rising costs of shipping, warehouse labour, and digital advertising. This coupled with low conversion rates does not make profitability easier.

Thinking in tradeoffs

For the most part of the 20th century, retail meant mass production, distribution, and consumption. But the future of retail is more complex and multidirectional. With digitization, the experience economy, and global perspectives influencing individual economies over the past few decades, retailers are starting to take on the challenge of personalization. How do we offer consumers

- More engaging experiences

- And customization opportunities

- At doable costs.

And all this at scale.

The e-commerce revolution has brought along a mosaic of platforms and fulfilment options that has added to the complexity. At the same time, the mushrooming online shopping opportunities have

- Increased transparency,

- Attracted more competition,

- And pushed down prices.

In light of this paradox, MIT Sloan’s investigation into how leaders are adopting strategies for the future leads to two approaches. A holistic retail reinvention that comes at a reasonable cost. The hypothesis: As retailers invest in products, people, and processes that deliver greater value, is there a way to capture value in return?

One. Exploring new streams of revenue.

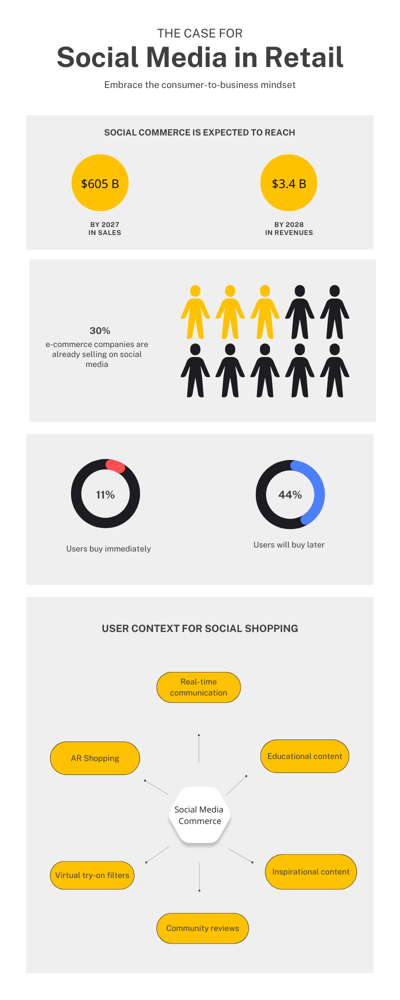

Two. Embracing consumer-to-business psychology.

The Old vs. the New

Deloitte recommends,

- Customer engagement, both real and virtual, through omnichannel offerings,

- Deeper specialization and niches,

- And innovation that is focused on driving returns through automation, immersive experiences, or simply reducing costs and overheads with meaningful partnerships.

This can remove friction, redefine services, and help organize operations by customer segments. But each element needs to be assessed in context and in light of what value it can bring to each stakeholder.

In the real world, this translates to new gains. Where the traditional retailer incurred costs of customer acquisition, physical infrastructure, labour, and full-fledged organizational capabilities in return for sales revenues and data, the new retailer eliminates the old for virtual stores, e-commerce capabilities, fulfilment partnerships, and digital infrastructure.

As a result, the customer gains, more ways to shop, AR/VR shopping experiences, VR filters and lenses, virtual try-on, personalized shopping experiences, discounted pricing, and social shopping opportunities. The retail function now is no longer siloed with sales, marketing, and support functions but a cohesive experience for every customer segment.

So, where private-label credit cards were a liability for retailers, BNPL players help create loyalty while encouraging revenues. Subscriptions, memberships, and referral programmes help add value to the core product, service, or experience offerings. E-commerce-enabled virtual stores with visual appeal. Digital catalogues. Quick checkouts. And customer connection points through logistics partners. Each emerging pattern offers opportunities for both employment generation and a frictionless supply chain. Ultimately bringing brands closer to customers.